So much in the world is broken right now. The planet is in turmoil, inequality is soaring, and government gridlocks are gloomier than ever. The Hollywood industrial complex regurgitates old stories and makes them worse, while music makers play more on the whims of algorithms than any sense of craftsmanship. Everything is so depressing. How I’d Fix It is Mic’s series of solutions to societal ills. Do you have a solution in mind? Email [email protected] with your pitch and be sure to include “How I would fix it” in the subject line.

Have you ever heard someone say that money doesn’t exist? Well, they’re right, but in a more literal sense than you might imagine. Nearly 90% of all money has no physical form. The banks are must only hold 10% of their reserves in physical cash at any time. The rest is just numbers on a screen – and most of that money is makes it a credit or a debt.

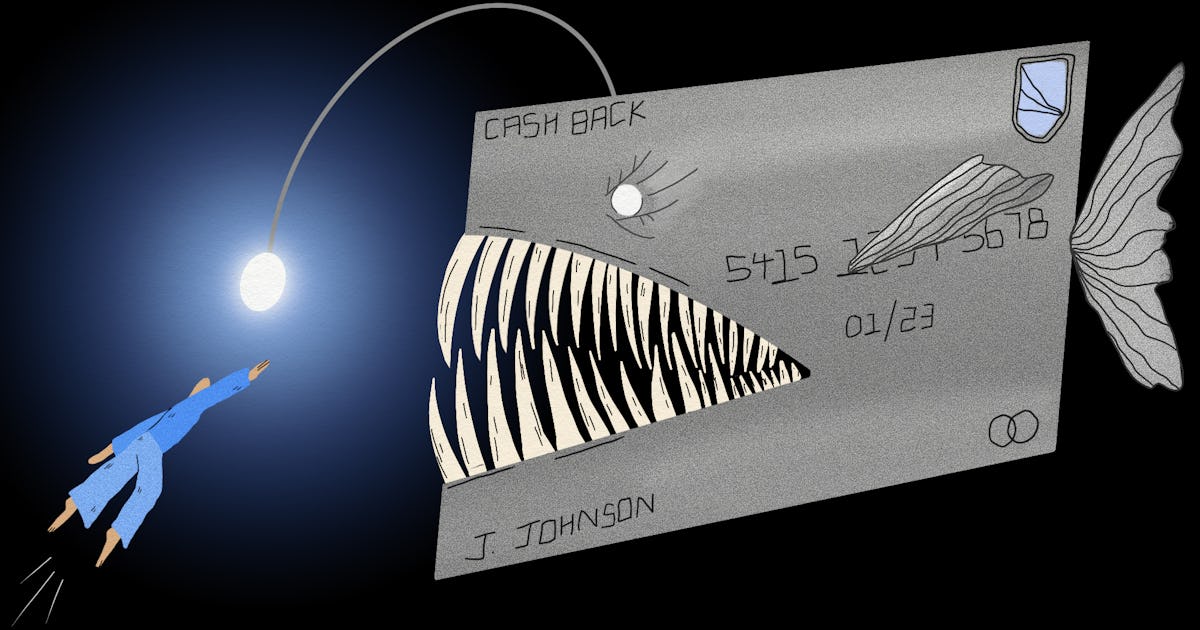

Think about it: most of your money isn’t cash or coins. It is invisible credit lent to you by credit card companies and financial institutions. The average American has more money available through lines of credit ($22,751) than by saving ($17,135). If a big purchase or an emergency arises, they are more likely to pay it on credit than cash. The system rewards this: as a general rule, the more available credit you have and the more lines of credit you actively maintain, the better your credit score will be. And while you get stung for having too much debt, carry some debt is rewarded.

Therein lies the credit and debt catch-22: In order to get bigger lines of credit and better terms to help minimize your debt and expenses, you need to have good credit. And if you don’t have good credit, trying to build it puts you at a higher chance of getting stuck in a debt trap. You are more likely to be exposed to high annual interest rates, end up with lower credit limits, and generally have a harder time improving your credit.

A low credit score cuts you off from ambitious purchases and essentials. Nearly 60% of millennials report that a low credit score caused them to lose a loan, with 1 in 4 reports being unable to get a car or an apartment due to credit checks. People are deprived of the real things they really need because of fake money which they cannot access because of a fake score. If that’s not enough to make you want to walk in the ocean, bless your resilience.

This system is garbage. It’s time to fix it. And the best tool we have for that is the government itself.

First, we have to dismantle the three main credit bureaus and destroy any black box containing the algorithm for generating credit scores. This, frankly, should not be controversial. The big credit bureaus – Equifax, Experian and TransUnion – are racketeering, and they’re not even good at what they do. Equifax leaked everyone’s social security numbers. The Federal Trade Commission has found that 1 in 4 people have errors in their credit reports that can affect their scores. You should review and dispute these errors in your spare time, and you even have to pay to view your report in its entirety (you only get a free credit report every year). Nobody likes credit bureaus, and they shouldn’t; they suck.

A solution here — and one that Biden’s presidential campaign would have considered — is a public credit registry. The Consumer Financial Protection Bureau can manage it, eliminating the profit motive that comes from owning all the data and selling access to it. The CFPB can create a transparent way to calculate credit scores, provide free access to credit reports, and standardize the process for reporting and deleting bad data. The National Consumer Law Center supports this ideajust like the think tank Demos. It’s a no-brainer, so let’s do it.

The next step would be to cancel a whole bunch of debt. Student debt? Let’s go ahead and delete this – you know, like President Biden could if he wanted to. So let’s get rid of the $81 billion in medical debt with which we have harassed people, which is apparently the price to pay to stay alive in a capitalist hellscape. We’ve already taken the smallest of baby steps toward a good job here, with the credit bureaus announcing that they won’t factor some medical debt into credit scores, but we should just avoid the hassle and write it all off together.

This all amounts to a reset. But the problem is that we are so deeply embedded in this debt system that we are unlikely to shake it completely without some kind of financial collapse or revolution. So instead of completely tearing down the walls, we can keep some of them and figure out how to bounce them back more productively.

Fortunately, we already have a powerful institution that knows a bit about invented money: the federal government. If the the money printer may begin to hum at any time to combat economic downturns or maintain cash flow during a global pandemic, it can surely be used to extend a line of credit to Americans who need access to financial support without the risk of bankruptcy or the trap debt.

Here’s how it will work: Once you turn 18, you’ll have access to a federally issued credit card. Steve Randy Waldman, computer programmer and economist who launched this idea in 2009, called it a Treasury Card Express. Awesome. The Treasury Express would guarantee everyone access to a line of credit.

How much, exactly? Waldman capped it at $1,000 in his proposal. Let’s go with a slightly more generous alternative, though, and tie at the median income in the United States in 2020, it was $35,805, which equates to about $3,000 per month. We therefore set the credit limit at $3,000. A large majority of the American working class lives paycheck to paycheck, and any interruption of it can be catastrophic. With a Treasury Express, if you suddenly find yourself without a job or income, you’ll have access to a line of credit large enough to cover a full month of median household expenses. (Mic reached out to Waldman for more details on his proposal but did not receive a response.)

If you’ve never had a credit card or accessed these types of financial services before, the federal card is a good introduction. “It improves access to financial instruments for those who couldn’t get credit or debit cards on their own, which means inclusion,” finance professor Dr. Tahira K. Hira told Mic. Personal and Consumer Economics at Iowa State University. It would also extend a line of credit to people who have historically been excluded.

This should also functionally eliminate the need for payday loans. About 12 million Americans use payday loans each year, usually in small amounts just to get by until their next paycheck. Payday loans are just about the worst credit product available, with extremely predatory rates that cause most payday loan recipients to pay far more in fees than they actually receive in financial support. Killing payday loans would be a welcome side effect of a federally issued line of credit.

You might be wondering what the interest rate on the federal card would be. Easy: 0%. That’s not to say there isn’t a penalty for default, of course. If you have a balance on your card, you’ll need to pay it off at the end of the month, with an additional month’s grace period to start paying it off. As long as you make payments for the balance, you will continue to have access to the line of credit. But not paying it back will restrict your access to other credit products offered by the government, such as home loans. After a period of five years, any outstanding balance would be canceled and you would once again have access to the full $3,000.

There will surely be people who will oppose this idea: “It is a handout from the government”; “It’s like giving people $3,000 free, they’ll just use it and not pay it back”; etc First, chances are people won’t give up access to other great lines of credit, like home loans, student loans, or other credit cards just to access $3,000 free. every five years. It would be a very bad financial decision.

“Are some people going to make mistakes and mismanage? Yes, it is possible,” says Hira. “But it is also [part of] a learning process. She notes that this system would help educate people about banking and credit in a much less risky way than our current setup.

And two, you’re fucking right, it’s a handout. Helping people improve their credit so they can access things like mortgages and car loans is a public good. We are better served if more people have the ability to own what they need. This card accomplishes that in our extremely failing credit system.

The current credit system is rigged in favor of people who already have a lot of money at their disposal and weighs on those who need help the most. Let’s expand much-needed access to credit with far fewer strings. If the economy is going to be credit and debt driven, the least we can do is make sure people can access it – and do so safely.

-1280x720.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/OXBOGDLIXNPTVC4653UVTMCWKU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/EF6WDGLY55BPNOPBGBAQQAXNSM.jpg)